Brett is a seasoned day trader with over eight years of experience in the financial markets.He is the Founder and CEO of Tradeify Funding, a platform offering instant funded trading accounts to traders seeking capital.

In trading, it’s not just about getting into a good position — it’s about knowing how to get out, smartly. That’s where the trailing stop limit order comes into play. This dynamic exit strategy helps lock in profits while allowing room for continued price movement. It’s a feature that separates disciplined, strategic traders from impulsive ones — and it may just become your favorite trading tool.

This guide will break down everything you need to know about the trailing stop limit order and how to use it effectively in stocks and forex.

What is a Trailing Stop Limit Order?

A trailing stop limit order is a type of trade exit order that dynamically follows the market price at a fixed distance (trailing amount). It is designed to:

- Protect profits as the market moves in your favor

- Avoid exiting too early during normal pullbacks

- Avoid slippage by using a limit order instead of a market order

Here’s how it works:

- You set a trailing amount (e.g., $1 or 50 pips).

- As the price moves in your favor, your stop price “trails” behind.

- When the price reverses by that amount, it triggers a limit order to sell (or buy).

This makes the trailing stop limit order especially useful in volatile markets where prices can move quickly, giving you better control over trade exits while maximizing profits.

Benefits of Using Trailing Stop Limit Orders

Why do seasoned traders swear by this tool? Here’s why:

- ✅ Locks in Gains Automatically: You don’t have to babysit every trade.

- ✅ Reduces Emotional Decision-Making: Takes you out of the equation.

- ✅ Improves Risk Management: Adjusts dynamically as price moves.

- ✅ Avoids Panic Selling: Prevents you from exiting on temporary pullbacks.

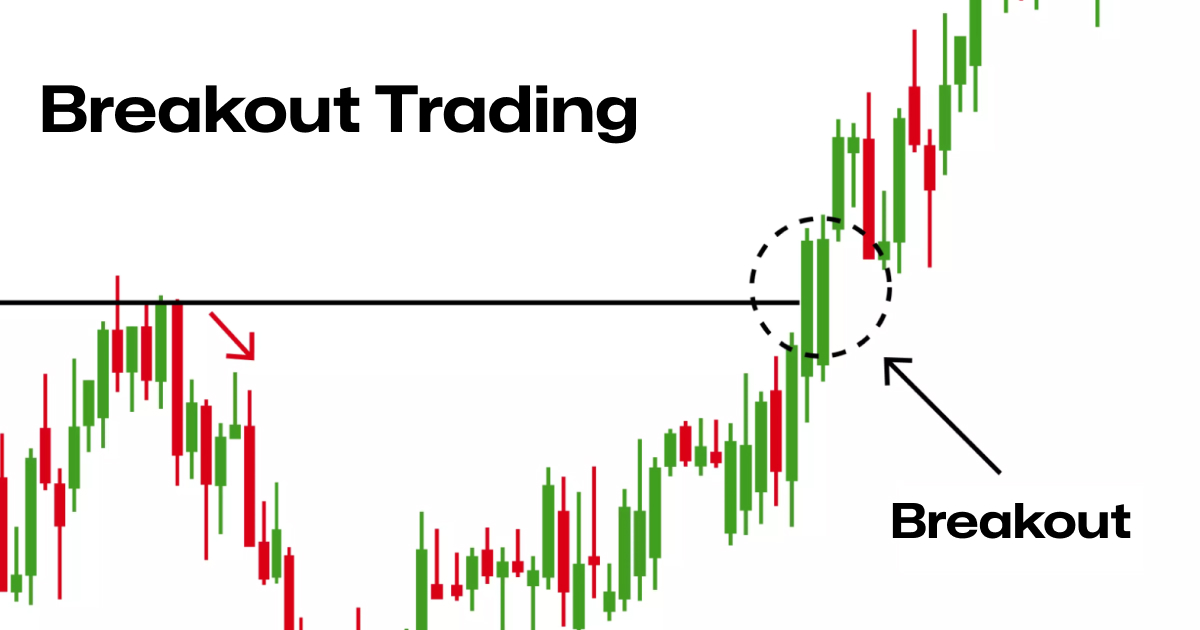

- ✅ Customizable for All Strategies: Works with trend following, swing trading, or even scalping.

- ✅ Built-In Discipline: Forces you to commit to risk parameters in advance.

- ✅ Enhances Trade Longevity: Helps keep winning trades open longer for maximum potential.

Trailing Stop Limit vs. Other Orders

Let’s compare it with common alternatives:

| Order Type | Follows Market? | Fixed Stop? | Uses Limit? | Emotion-Free? |

|---|---|---|---|---|

| Market Order | ❌ No | ❌ No | ❌ No | ❌ No |

| Stop Loss Order | ❌ No | ✅ Yes | ❌ No | ✅ Yes |

| Limit Order | ❌ No | ✅ Yes | ✅ Yes | ✅ Yes |

| Trailing Stop Limit | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes |

It combines the best features of stop and limit orders with dynamic adjustment.

When to Use a Trailing Stop Limit Order

Use this tool when:

- 📈 You’re in a winning trade and want to ride the trend while locking in profits

- 🔄 You expect volatility and want to avoid being stopped out prematurely

- 🧠 You want to automate exits and reduce emotional bias

- 📊 You’ve reached a key technical level and want protection without a full exit

- 📉 You trade high-beta stocks or currency pairs with frequent retracements

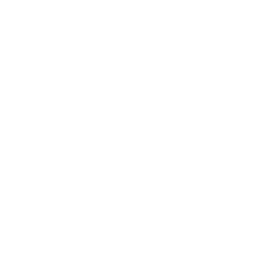

Trailing stop limit orders are especially effective in breakout strategies, where price momentum can carry trades far beyond the initial entry point.

How to Set It Up (Step-by-Step)

Let’s say you’ve gone long on a stock at $100. Here’s how you can set a trailing stop limit order:

1. Choose Your Trail Amount

- Example: $2 below the current price

- The stop price will always be $2 below the highest price reached

2. Set Your Limit Offset

- This is the distance from the stop price where your limit order will be placed

- Example: $0.50 below the stop (so the sell limit is $2.50 below the high)

3. Monitor and Adjust If Needed

- Most platforms do this automatically — just set and let it work

- However, you may want to widen the trail or limit offset during volatile sessions

4. Trigger and Execution

- If the price reverses $2 from its high, a limit order is triggered

- The order only fills if the price can meet the limit — protecting you from bad fills

This level of control makes the trailing stop limit order ideal for traders who want to avoid market order slippage while maintaining a rules-based approach.

Example in Stocks: Apple (AAPL)

- Buy at $150

- Set a trailing stop of $3 and limit offset of $0.50

- Price rises to $160 → trailing stop moves to $157, limit order at $156.50

- Price dips to $157 → stop triggered → sell order placed at $156.50

- If price bounces quickly, the order may not fill — but it protects you from poor fills below your limit

Example in Forex: EUR/USD

- Buy at 1.1000

- Trailing stop of 50 pips, limit offset of 10 pips

- Price reaches 1.1100 → stop moves to 1.1050, limit at 1.1040

- Price falls → stop triggers → limit order executes at 1.1040

- If price drops rapidly, the order may not fill — so selecting an appropriate limit offset is essential

Mistakes to Avoid

Don’t make these common errors:

- ❌ Setting too tight a trail — you’ll get stopped out during normal fluctuations

- ❌ Forgetting the limit offset — this can cause your order to miss execution

- ❌ Using in illiquid markets — spreads can trigger false exits

- ❌ Using without testing — paper trade first to understand the behavior

- ❌ Overcomplicating with multiple overlapping orders — keep it clean and strategic

Pro Tips for Success

- 🔁 Adjust trail amount based on volatility (use ATR indicators)

- 🛑 Combine with chart levels like support/resistance

- 💡 Use in conjunction with moving average strategies

- 🔔 Set alerts near your stop to keep tabs on major moves

- 📚 Journal every trade using this method to improve

- 📈 Backtest various trail/offset combinations to find what fits your strategy best

- 🧠 Understand that unfilled limit orders mean you stay in control — and sometimes that’s the best outcome

Maximize Your Strategy with Tradeify

Tools like the trailing stop limit order are what differentiate casual traders from professionals. But to unlock its true potential, you need the right environment.

Join Tradeify today and get:

- Access to institutional-grade trading tools

- Risk-free funding accounts

- Community insights from seasoned traders

- Deep-dive tutorials on advanced order types

- Real-time strategy analysis from top-performing prop traders

Don’t just trade. Trade with precision — with Tradeify.

Final Thoughts

The trailing stop limit order is a strategic weapon for modern traders. It helps you stay in profitable trades longer, reduce emotional interference, and exit with control. Whether you're trading forex or stocks, mastering this tool can give you an edge others overlook.

It encourages a mindset of structure, discipline, and forward-thinking execution — all traits of consistently successful traders.

Start using it today — and bring more structure and success to your trading journey with Tradeify by your side.

.svg)

Get up to $750k instant sim funding

- Start earning payouts instantly

- Super fast automated payouts

- Free journal to improve

.svg)

.svg)

.webp)