Brett is a seasoned day trader with over eight years of experience in the financial markets.He is the Founder and CEO of Tradeify Funding, a platform offering instant funded trading accounts to traders seeking capital.

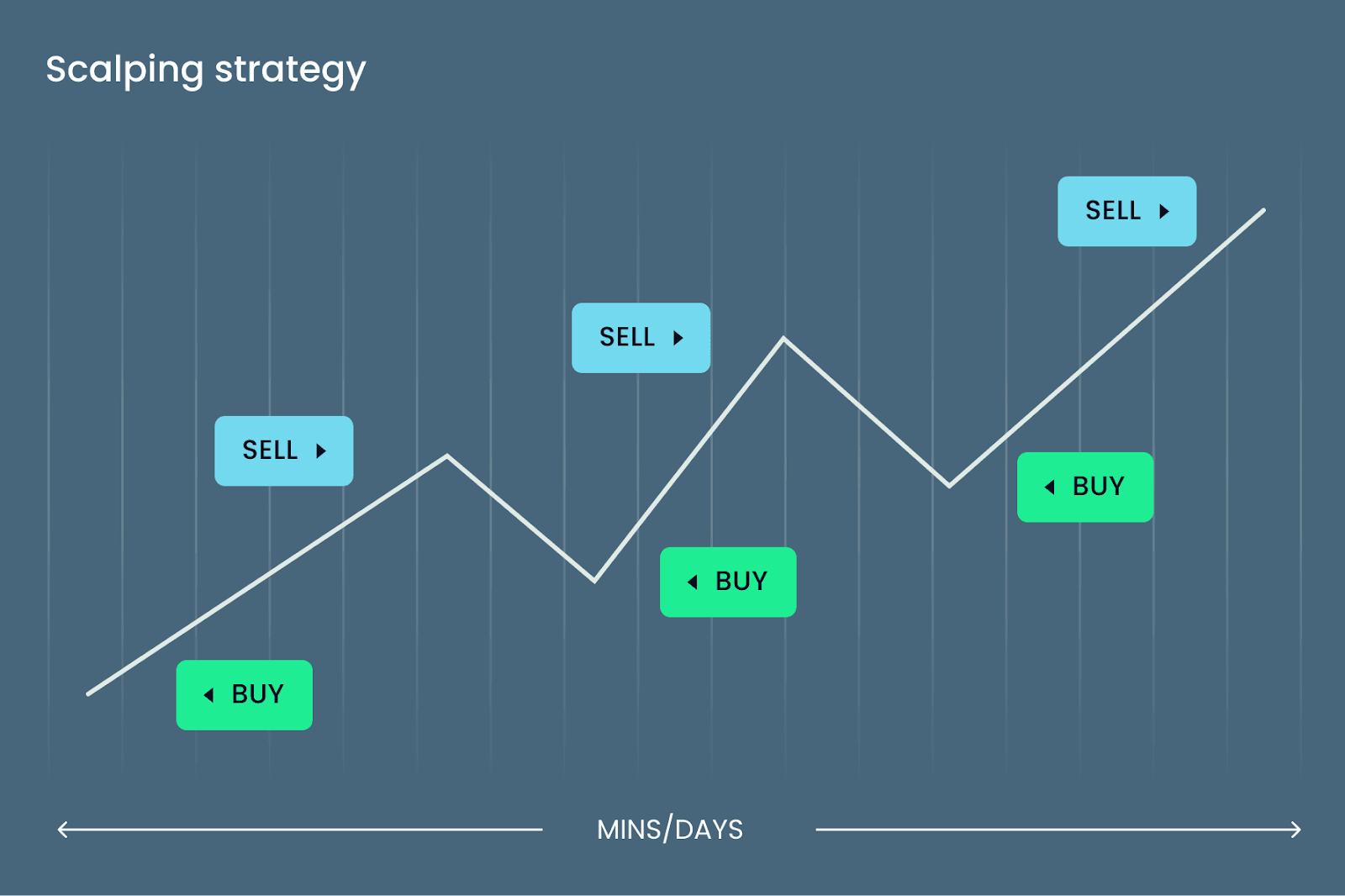

Scalp trading, a popular trading strategy, involves taking advantage of small price fluctuations with rapid trade execution. While it offers potential for frequent profits, it also comes with inherent risks and challenges. This article outlines the five most common mistakes in scalping and provides actionable strategies on how traders can avoid them effectively.

Understanding Scalp Trading

This strategy involves making numerous trades over a very short period, aiming to gain small profits from minor price changes. Traders who scalp usually hold positions for seconds to minutes, closing them quickly once a profit target is reached.

Advantages of Scalp Trading:

- Quick profit opportunities

- Reduced market exposure

- Increased trade frequency

- Ability to profit in various market conditions

Risks and Challenges:

- High transaction costs

- Emotional stress and pressure

- Requires intense concentration and quick decision-making

- Greater susceptibility to market noise

Let's now explore in detail the most common scalp trading mistakes and how to avoid falling into these traps.

Mistake 1: Inadequate Preparation and Strategy

One significant mistake traders make in scalp trading is entering the market without a well-defined strategy or adequate preparation. Many traders underestimate the importance of preparation, leading to impulsive decisions based on emotions rather than analysis.

How to Avoid It:

- Develop and strictly adhere to a clearly defined strategy.

- Perform thorough market analysis before entering trades.

- Regularly backtest your trading strategy to refine and improve its effectiveness.

- Keep detailed records of your trades to analyze your strengths and weaknesses.

- Simulate trading with demo accounts to build experience without risking real money.

- Continuously refine your trading strategy based on real-time market experiences and feedback.

Mistake 2: Ignoring Risk Management Principles

Effective risk management is crucial in scalp trading due to the frequency of trades and small profit margins. Traders often make the mistake of ignoring proper risk management practices, leading to significant financial losses.

How to Avoid It:

- Set clear stop-loss and take-profit targets for each trade.

- Maintain strict discipline in adhering to your stop-loss levels.

- Calculate the appropriate trade size based on your account balance and risk tolerance.

- Aim for a favorable risk-to-reward ratio (at least 1:1 or higher).

- Avoid the temptation to widen stop-losses in hopes of trades turning profitable.

- Regularly review and adjust your risk management parameters to align with current market volatility.

Mistake 3: Overtrading

Overtrading is common among scalp traders, often resulting from the desire to recover losses quickly or capitalize on every perceived opportunity. However, trading excessively without strategic justification increases transaction costs and heightens emotional stress.

How to Avoid It:

- Limit your daily trades and adhere strictly to your trading plan.

- Take regular breaks to maintain focus and clarity.

- Recognize emotional triggers and learn when to step away from trading.

- Focus on quality trade setups rather than quantity.

- Establish daily or weekly trading limits to manage your activity effectively.

- Evaluate each trade objectively and ensure it meets all your pre-defined trading criteria before execution.

Microscalping - Microscalping involves executing rapid trades to profit from minimal price movements, typically within seconds.

- Tradeify seeks committed traders whose strategies can be reliably replicated and potentially copied by our firm. Since trades lasting under 5 seconds are challenging to copy effectively, we recommend that at least 50% of your profits come from trades held longer than 5 seconds.

This is a guideline—not a strict rule—and flagged accounts are always reviewed by our team. For more details, see our trading guidelines.

Mistake 4: Neglecting Market Volatility and Conditions

Scalp trading is highly sensitive to market volatility and liquidity conditions. Traders who overlook the importance of these factors risk entering trades during unfavorable conditions, leading to higher losses or missed profit opportunities.

How to Avoid It:

- Monitor market volatility indicators closely (e.g., Average True Range, Bollinger Bands).

- Adapt your scalp trading strategy according to changing market conditions.

- Avoid trading during extremely volatile periods, such as major news events, unless specifically prepared.

- Stay informed about macroeconomic events that can significantly impact market volatility.

- Learn to interpret price action accurately during volatile market conditions.

- Practice identifying volatility patterns that consistently yield successful trade setups.

Mistake 5: Emotional Trading and Lack of Discipline

Emotional trading is arguably the most detrimental mistake in scalp trading. Allowing emotions such as fear or greed to influence decisions often leads to irrational trading behaviors, including chasing losses, premature exits, or excessive risk-taking.

How to Avoid It:

- Maintain emotional detachment by sticking strictly to your trading plan.

- Implement automated trading tools or alerts to minimize impulsive decision-making.

- Regularly practice stress management techniques, such as mindfulness or meditation.

- Develop strong discipline through consistent practice and clear trading guidelines.

- Seek mentorship or peer support to help maintain accountability and emotional balance.

- Reflect regularly on emotional triggers and develop specific strategies to manage them proactively.

Essential Scalp Trading Tips to Succeed

Beyond avoiding mistakes, consider these additional strategies to enhance your trading performance:

- Choose the Right Market: Opt for markets with high liquidity and tight spreads, facilitating quick and cost-effective trades.

- Use Appropriate Timeframes: Select short-term timeframes (e.g., 1-minute or 5-minute charts) to align with your strategy.

- Focus on High-Probability Setups: Prioritize clear and strong trading signals to enhance profitability and consistency.

- Continuous Education: Regularly update your knowledge and skills to adapt to evolving market conditions and strategies.

- Leverage Technology: Utilize our advanced trading platform and tools designed for scalp trading to gain a competitive edge.

- Stay Informed: Keep abreast of market news and updates, using economic calendars to anticipate potential market movements.

- Analyze Trading Patterns: Regularly review your trade history to identify patterns or habits that impact your trading negatively and make necessary adjustments.

- Manage Expectations: Understand that consistent profitability in scalp trading requires patience, realistic goals, and disciplined execution.

- Network with Other Traders: Engaging with our community of traders can provide valuable insights, shared experiences, and support to enhance your trading strategies.

- Balance Trading with Lifestyle: Ensure adequate rest, nutrition, and physical activity to maintain peak mental clarity and performance in fast-paced scalp trading environments.

Final Thoughts

Scalp trading, when executed correctly, offers exciting profit potential due to its dynamic and fast-paced nature. By avoiding common mistakes such as inadequate preparation, poor risk management, overtrading, neglecting market conditions, and emotional trading, traders can significantly enhance their performance and profitability. Embrace discipline, continuous learning, and effective risk management as foundational elements of your scalp trading journey, ensuring sustained success and growth as a trader.

.svg)

Get up to $750k instant sim funding

- Start earning payouts instantly

- Super fast automated payouts

- Free journal to improve

.svg)

.svg)

.webp)