Brett is a seasoned day trader with over eight years of experience in the financial markets.He is the Founder and CEO of Tradeify Funding, a platform offering instant funded trading accounts to traders seeking capital.

Implementing stop-loss and take-profit orders simultaneously in one transaction is crucial for effective risk management and maximizing trading efficiency. This practice helps traders automate their risk-reward strategy, maintaining discipline and reducing emotional decision-making. In this comprehensive guide, you'll learn how to effectively set stop-loss and take-profit levels within a single transaction, ensuring strategic precision in every trade you place.

Understanding Stop Loss and Take Profit Orders

Stop-loss and take-profit orders are automated tools traders use to exit positions once predetermined price points are reached:

- Stop Loss: Automatically closes a losing trade at a specified price level, helping to control and limit potential losses.

- Take Profit: Automatically closes a profitable trade once a predefined price target is reached, ensuring gains are secured.

Implementing these orders together helps streamline your trading approach, reducing guesswork and increasing consistency.

Benefits of Combining Stop Loss and Take Profit in One Transaction

Combining stop-loss and take-profit orders in a single transaction delivers several key advantages:

- Enhanced Risk Management: Clearly defined loss limits reduce risk exposure.

- Automation and Discipline: Helps traders stick to predefined strategies without emotional interference.

- Improved Efficiency: Saves time by automating exits, freeing traders to focus on new market opportunities.

- Clear Risk-Reward Ratios: Enables precise calculation of expected profitability, ensuring strategic decision-making.

Step-by-Step Guide to Setting Both Orders in One Transaction

To implement stop-loss and take-profit orders simultaneously, follow these detailed steps:

1. Choose Your Trading Platform

Select a reliable platform like Tradeify that supports advanced order types like OCO (One Cancels Other) or bracket orders. These tools automatically manage your orders by canceling one as soon as the other is executed.

2. Define Your Trading Strategy

Clearly outline your trading strategy by identifying your entry price, profit targets, and acceptable risk levels. A robust strategy considers market trends, volatility, support and resistance levels, and overall market sentiment.

3. Identify Your Entry Point

Carefully analyze the market using technical indicators, chart patterns, or fundamental analysis to pinpoint your entry price accurately. A precise entry improves the effectiveness of your stop-loss and take-profit levels.

4. Determine Stop Loss Placement

Strategically determine your stop-loss levels based on market structure:

- For long positions, place stop-loss slightly below recent support levels, ensuring sufficient buffer space to account for volatility.

- For short positions, place stop-loss slightly above recent resistance levels.

5. Establish Take Profit Levels

Identify realistic profit targets by analyzing historical price movements, upcoming resistance or support levels, and overall risk-reward calculations:

- For long positions, set take-profit near significant resistance zones.

- For short positions, set take-profit near crucial support zones.

6. Execute Bracket or OCO Orders

Use bracket or OCO orders to simultaneously place stop-loss and take-profit orders. The first order executed will automatically cancel the other, streamlining your trading process and minimizing errors.

Advanced Strategies for Setting Stop Loss and Take Profit

Beyond basic setups, experienced traders apply advanced strategies to fine-tune their orders further:

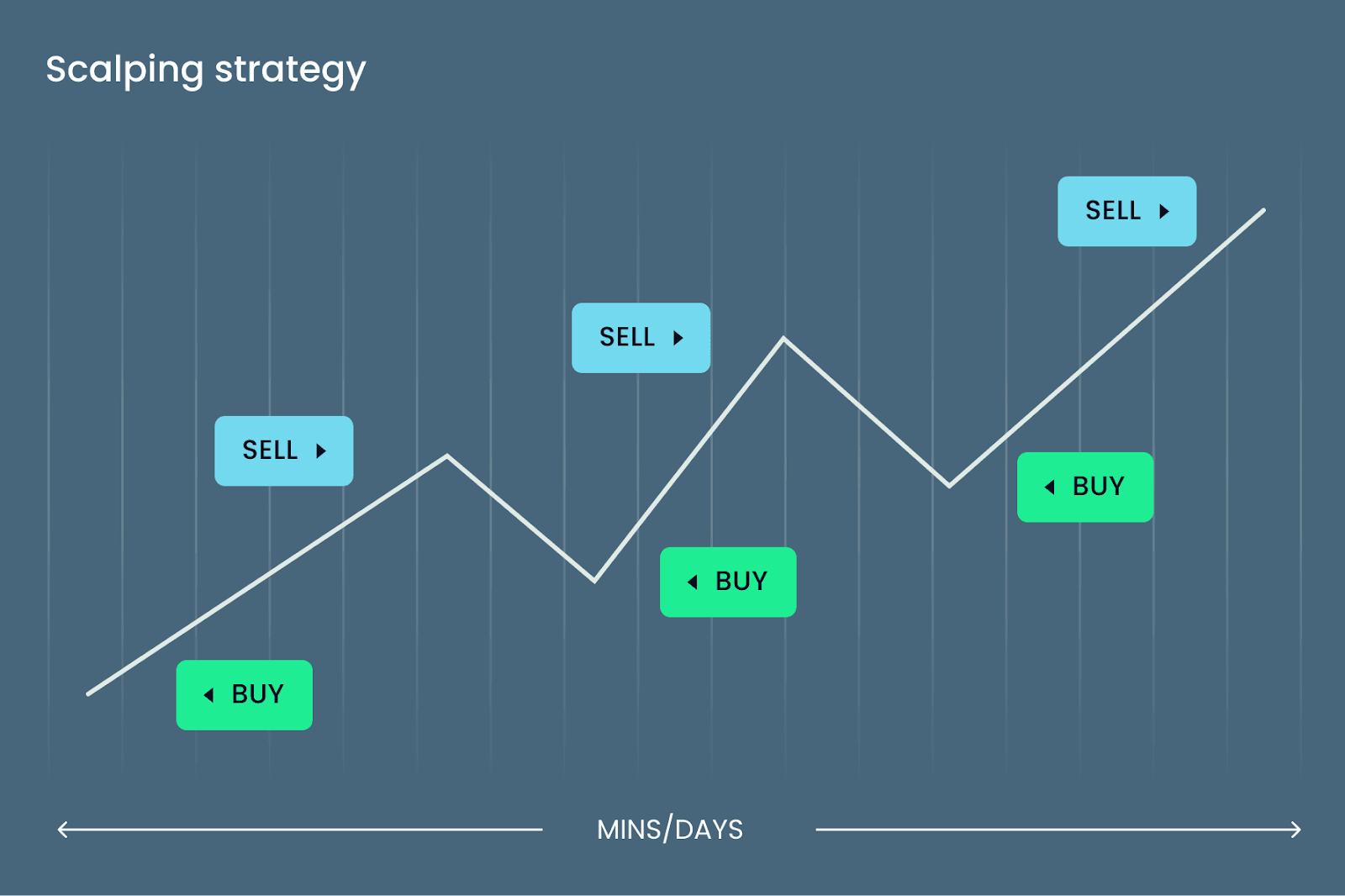

Dynamic Trailing Stops

Trailing stops move dynamically as your trade becomes profitable, locking in profits incrementally while allowing for further gains.

Scaling Out Positions

Gradually close portions of your trade at different profit targets to manage risk, secure early profits, and still benefit from further favorable moves.

Multiple Timeframe Analysis

Analyze your trade across multiple timeframes to identify optimal stop-loss and take-profit levels, ensuring alignment with both short-term and long-term market trends.

Volatility-Based Adjustments

Adjust your stop-loss and take-profit levels based on current volatility metrics such as Average True Range (ATR). This ensures your orders accurately reflect market conditions, reducing premature exits or missed opportunities.

Practical Tips for Effective Implementation

To optimize your strategy and execution, consider these practical tips:

- Maintain Reasonable Risk-Reward Ratios: Target at least a 1:2 ratio (risk one unit for a potential gain of two units).

- Regularly Adjust Your Orders: Stay responsive to market conditions by reviewing and updating your stop-loss and take-profit orders as market dynamics evolve.

- Account for Volatility: Adapt your orders according to volatility, avoiding overly tight stops that may trigger premature exits.

- Use Backtesting: Test your stop-loss and take-profit strategy against historical market data to refine and optimize your approach before deploying it live.

Common Mistakes and How to Avoid Them

Be cautious of these frequent errors when setting combined orders:

- Placing Stop-Loss Too Close: Give your trades sufficient breathing room by avoiding overly tight stop-loss settings.

- Ignoring Broader Market Trends: Always evaluate your orders within the larger market context, avoiding decisions based solely on isolated price movements.

- Neglecting Regular Reviews: Regularly reassess your orders to ensure they remain effective under current market conditions.

- Lack of Clear Strategy: Avoid setting arbitrary stop-loss and take-profit levels. Always base these decisions on clear, well-thought-out strategies.

Advantages of Using Combined Orders

Utilizing combined stop-loss and take-profit orders offers significant practical benefits:

- Automates trade management for smoother trading.

- Removes emotional bias, encouraging disciplined trading decisions.

- Clarifies risk exposure, enhancing overall trading confidence.

Limitations and Risks

Despite substantial advantages, combined orders also have certain limitations:

- Vulnerable to market volatility causing premature triggers.

- Require constant attention and occasional adjustment for accuracy.

- Can result in missed opportunities if improperly configured.

Enhance Your Trading with Tradeify

Tradeify simplifies complex trading processes, empowering traders with intuitive tools for effortlessly managing simultaneous stop-loss and take-profit orders. Enhance your trading precision and efficiency with Tradeify’s robust and user-friendly platform.

Conclusion

Mastering the art of simultaneously setting stop-loss and take-profit orders significantly enhances your risk management and trading performance. By systematically defining entry, exit, and profitability levels, traders gain strategic control and discipline in their trading approach. Commit to continuously refining your strategy, leveraging advanced tools, and maintaining disciplined execution to consistently achieve better trading outcomes.

.svg)

Get up to $750k instant sim funding

- Start earning payouts instantly

- Super fast automated payouts

- Free journal to improve

.svg)

.svg)

.webp)